In recent years, there has been a significant increase in the complexity of insurance products, along with a growing demand for insurance intermediaries in the implementation of insurance products and the identification of key needs of both individual clients and the business environment. Qualified and trained insurance intermediaries play a crucial role in improving the quality of insurance services, protecting the interests of policyholders, and ensuring transparency in the relationship between the policyholder and the insurance company. Long-term trust relationships with insurance intermediaries can only be built with sufficient professional training of such intermediaries.

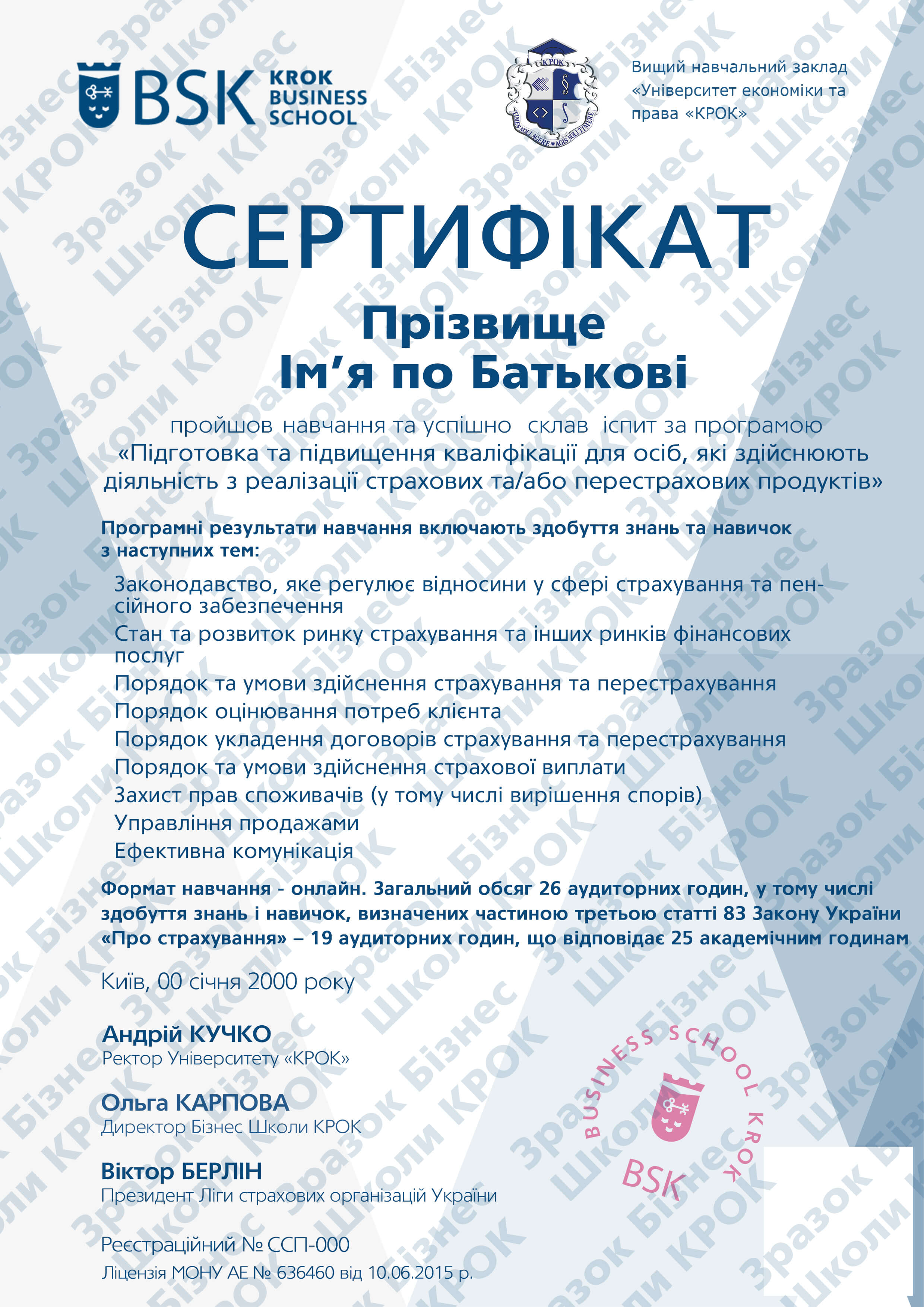

In accordance with the requirements of the new "Insurance Law," the program is designed to train insurance intermediaries and employees involved in the implementation of insurance and/or reinsurance products. It is for those who want to gain professional and in-depth qualifications as an insurance intermediary from the best market specialists, and for those who want to quickly master the basic principles of insurance and intermediary activities as defined by the legislative framework.

Leaders of the League of Insurance Organizations of Ukraine, the "Insurance Business" Association, the Federation of Insurance Intermediaries of Ukraine, insurance market professionals, business trainers, and instructors from the KROK Business School.